Elder Financial Abuse: How to Protect Your Loved Ones

Elder financial abuse is a serious issue that affects millions of older adults every year. Unlike physical abuse, financial exploitation can be subtle and harder to detect, often perpetrated by trusted family members, friends, or caregivers. This article delves into the nuances of elder financial abuse, offering advice for older adults to protect themselves, as well as tips for caregivers of elderly relatives. We’ll focus on how to protect yourself and your loved ones, and where to report elder financial abuse if you suspect it has occurred.

What is elder financial abuse?

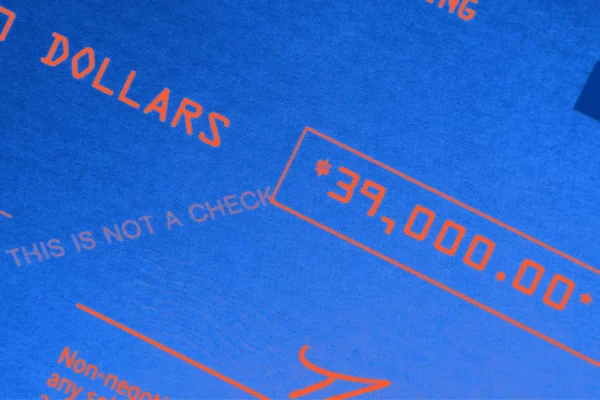

Elder financial abuse or neglect involves the illegal or improper use of an older person’s funds, property, or assets. It can manifest in various forms, including theft, fraud, misuse of power of attorney, and undue influence to alter wills or other financial documents. The impact of such abuse can be devastating, leading to financial ruin, emotional distress, and a diminished quality of life for the victim.

Protecting Yourself

As an older adult, safeguarding your financial well-being is paramount. Financial exploitation can happen to anyone, but by taking proactive measures, you can significantly reduce your risk of becoming a victim. Empower yourself with knowledge and take control of your financial security by following these essential steps:

- Stay Informed: Keep yourself informed about common financial scams and warning signs of abuse. Attend workshops, read up on the latest scams targeting older adults, and remain vigilant about new methods fraudsters may use.

- Monitor Finances: Regularly review your bank accounts, bank statements, credit cards, and financial documents. Keeping a close eye on your accounts can help you spot any unusual activity early. Set up alerts with your bank for large transactions or changes to your account.

- Trusted Contacts: Designate a trusted family member or friend to help monitor your finances, but ensure this person is genuinely trustworthy. It’s vital to choose someone who respects your autonomy and has your best interests at heart.

- Power of Attorney: Be cautious when granting power of attorney. Make sure it is someone you trust implicitly and consider legal advice before doing so. A lawyer can help you set up safeguards and specify the extent of the authority granted.

- Pressure: Beware of anyone pressuring you to make immediate financial decisions. High-pressure tactics are a red flag, and it’s crucial to take your time to understand and consider any financial decisions thoroughly.

- Unusual Requests: Be cautious if someone asks for your financial information or offers to manage your finances unexpectedly. Verify their intentions and consult with a trusted advisor or family member before sharing any information.

- Documentation: Keep all your financial and legal documents in a secure place and be wary of anyone trying to access them without your permission. Use a safe or a locked drawer and ensure that only trusted individuals know their location.

By taking these steps, you can create a robust defense against potential financial exploitation and maintain control over your financial affairs.

Protecting Your Loved Ones

Caregivers and family members play a crucial role in safeguarding older adults from financial abuse. Your involvement and vigilance can make a significant difference in preventing financial exploitation and ensuring the financial security of your loved ones. Here are some key strategies to help protect them:

- Regular Check-Ins: Frequently check in on your loved ones and their financial situation. Regular conversations about their finances can help you detect any irregularities or signs of abuse early on.

- Educate: Help them understand the common tactics used by financial abusers. Provide information on how to recognize and respond to potential scams or exploitation attempts. Education is a powerful tool in preventing financial abuse.

- Professional Help: Encourage them to seek professional financial advice. Financial advisors, attorneys, and accountants can offer guidance and protection, helping older adults make informed decisions and spot potential risks.

By staying informed and vigilant, you as a caregiver—or merely as a concerned relative or friend—can work with your loved one to prevent financial abuse and ensure a secure financial future.

Reporting Elder Financial Abuse

Financial abuse is a crime and reporting it to the appropriate authorities is a crucial step. If you notice any of the tell-tale signs of elder financial abuse, there are various agencies whose purpose is to protect elderly adults in the United States. Also, reporting suspicious activities to your or your loved one’s financial institutions or local authorities can prevent further harm. The following agencies and institutions can help if you think elder financial abuse has occurred:

- Adult Protective Services (APS): Each state has an APS agency that investigates reports of elder abuse, including financial exploitation.

- National Center on Elder Abuse (NCEA): The NCEA provides resources and information on how to report elder abuse. Visit their website for more details.

- Financial Institutions: Report suspicious activities to the victim’s bank or financial institution. They can freeze accounts and conduct investigations.

- Local Police: If you believe a crime has been committed, contact your local police department.

- Long-Term Care Ombudsman: If the abuse occurs in a nursing home or long-term care facility, report it to the state’s long-term care ombudsman.

Legal Recourse

If you or a loved one has been a victim of elder financial abuse, there are several legal avenues you can pursue to seek justice and potentially recover lost assets. Taking swift legal action can help protect financial interests and hold the perpetrators accountable.

- Seek Legal Advice: Consult with an attorney who specializes in elder law to explore your legal options. An experienced elder law attorney can provide guidance on the best course of action based on the specifics of your case. They can help you understand your rights, the laws that protect you, and the steps needed to build a strong case against the abuser.

- File a Civil Suit: In some cases, it may be possible to recover stolen assets through a civil lawsuit. A civil suit can be filed against the individual or entity responsible for the financial abuse. This legal action aims to obtain financial compensation for the damages suffered. Your attorney can help you gather evidence, file the necessary paperwork, and represent you in court.

- Guardianship and Conservatorship: In situations where an older adult is unable to manage their own financial affairs due to cognitive decline or other issues, it may be necessary to establish a guardianship or conservatorship. This legal process appoints a responsible party to manage the older adult’s finances and protect them from further abuse. Your attorney can assist in navigating this process and ensuring that the appointed guardian or conservator acts in the best interests of the elder.

Work Together to Prevent Financial Exploitation

Elder financial abuse is a pervasive problem that requires vigilance and proactive measures to prevent. By understanding the warning signs elder financial abuse and knowing where to report elder financial abuse, older adults and their caregivers can work together to protect against financial exploitation. Remember, it’s crucial to stay informed, monitor financial activities, and seek help when necessary to ensure the financial safety and well-being of older adults.

Protecting the elderly from financial abuse not only secures their assets but also upholds their dignity and independence. Stay aware, stay informed, and take action if you suspect elder financial abuse.